By Richard Wayman, BHA Race Director

In January we will publish a review at the halfway point of our two-year test of schedule changes designed to raise the sport's appeal to customers. At the start of the trial we set twelve objectives and the review will provide an overview of how things progressed in relation to each of these objectives. That certainly seems to provide a mixed picture, but more on that next month.

In the meantime, we can publish the latest racing events Data reportwhich covers the first 11 months of 2024, and in this month's blog I will focus on two elements of that report.

I'll start with our goal to improve the competitiveness of racing in 2024. You may remember that this meant we had to plan 300 fewer jump races and move a significant number of flat races from summer to fall.

Key field size figures are included in the race data report and show that the average field size on the Flat (both Premier and Core) has reached its highest level in recent years. This also applies to Core Jumping, although the average field size for Premier Jump games is below 2023 levels. More about that later in this blog.

My colleagues in the BHA racing department have been working with racetracks to make changes to the composition of the racing program and to better spread races throughout the year to aid deliver more competitive racing for fans of the sport. The latter involved modeling the predicted number of runners over the course of the year and then adjusting the number of races based on participant sizes.

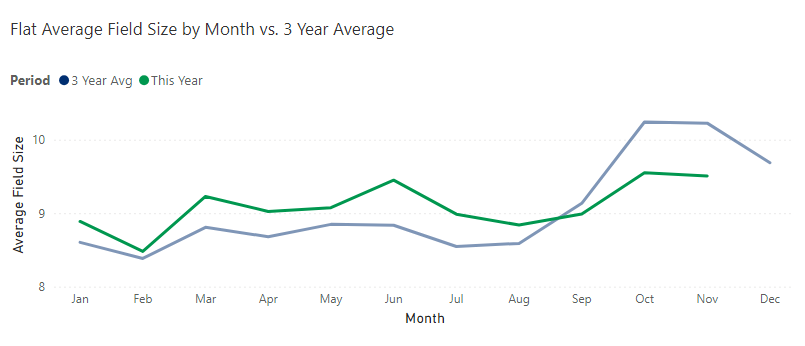

The graphics below illustrate that this has resulted in more consistent competitive racing for both codes. The graphic below shows field sizes on the Flat, with the blue line representing the three-year average field size over the course of the year (2021-2023), with fields dwindling in the summer and then growing rapidly in the fall. However, in 2024 we have been able to deliver consistently better field sizes, with the green line generally higher and less variable than before.

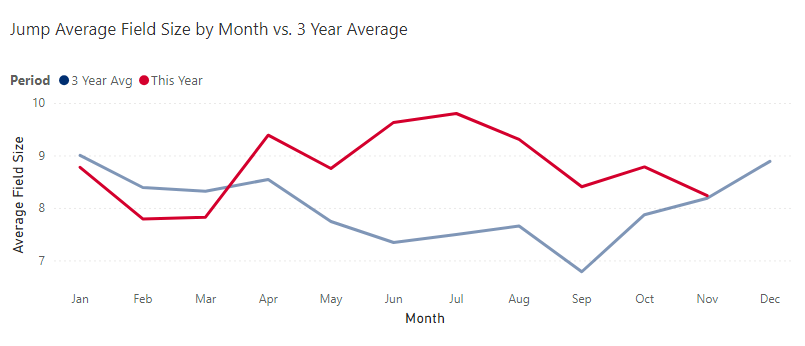

There were also improvements over Jumps, with average field sizes in 2024, represented by the red line in the chart below, consistently above the three-year average, represented by the blue line. However, the table also shows the importance of the soil condition. The smaller field sizes in the first three months of the year, when conditions were very humid and 78% of games were played on tender or bulky ground, compared to the three-year average of 48%, are an indication that the elements will continue to be humid have a massive influence on when and where horses run, especially over obstacles. This will of course have impacted the average field size at Premier Jump games, many of which take place in the first quarter of the year.

Turning to another area within the racing data report, I have said in previous blogs that the decline in quality jump horses racing in the UK is probably the most worrying of all the figures we report on each month.

The number of horses achieving a performance of 130 or above in at least one race during the year has been dwindling for some time, recording an 11.5% decline from 729 to 645 compared to last year.

There will be a number of factors contributing to this worrying trend, including a much lower number of flat horses going into show jumping as more of them are exported or run on all-weather horses throughout the winter, the increasing commercial challenges associated with the Breeding of show jumping horses, and changes in the profile of racehorse owners with fewer sole owners and owner breeders, an increased concentration of higher quality horses in fewer hands in both the UK and Ireland and the realignment of the Handicap file that has generally resulted in lower handicap ratings.

Working with various partners across the sport, several measures have been introduced to support show jumping in recent years, including:

- Changes to the Pattern and Listed Jump program are designed to aid strengthen the upper tier of the program, with races repositioned and in some cases removed altogether where other similar opportunities exist.

- The creation of Jump Premier Racedays has strengthened racing programs and increased prize money at these events (plus £2.5m in 2024).

- Over the last decade, a long-term strategy has been pursued to raise the attractiveness of a jump mare in training. The strategy particularly focused on increasing the number of high-quality mares.

- Under the direction of the TBA and with the support of the Levy Board, the Great British Bonus was created to encourage the breeding, purchase and ownership of fillies. Following the recent expansion of the GBB (which will raise payments to steeplechase mares), this is expected to result in jump bonuses of around £1.5m in 2025.

- Complementary to the Great British Bonus, the Elite Mares Scheme delivers outstanding performance and encourages the retention of high quality jump mares for breeding purposes.

- The creation of Junior National Hunt Hurdle racing with the aim of supporting the development of newborn jump horses and, where appropriate, encouraging more of these horses to overcome obstacles earlier in their careers.

There has obviously been no lack of activity, but we must admit that these measures have not been enough to halt the decline in the number of quality jump horses. Stopping and even reversing this trend is high on our list of future goals and is therefore, not surprisingly, the subject of ongoing work.

This will take time and require action on multiple fronts. However, we are confident that with patience, perseverance and a concerted effort across the sport we can reverse this trend and look forward to seeing more and more quality horses competing over obstacles at British racecourses in the coming years.